Welcome to Corporate2Finance, where we strive to simplify your corporate and financial journey. In this blog post, we are excited to present an incredibly useful tool – our Income Tax Calculator Excel Template. Designed to streamline the Income tax calculation process, this template helps you calculate your Taxable income as an excel file. Read on to discover the features of the calculator and gain insights into optimizing your tax liabilities.

Table of Contents

This Income Tax Calculator Excel not only calculates your Tax and Taxable Income, but also compares your Tax and deductions as per both New Tax Regime and Old Tax Regime. This way it makes it easier for you to decide which tax regime works better for you.

New Tax Regime of Budget 2023:

Government of India introduced a New Tax Regime in the budget of 2020, wherein they altered the Tax slabs for the taxpayers.

Here’s the breakdown of the key points in a more formal tone:

-

Tax Slabs: The new system introduces six tax slabs, with zero tax for incomes up to ₹3 lakh. The tax rate gradually increases by 5 percentage points for each incremental ₹3 lakh.

- Up to ₹3,00,000: Nil

- ₹3,00,001 to ₹6,00,000: 5%

- ₹6,00,001 to ₹9,00,000: 10%

- ₹9,00,001 to ₹12,00,000: 15%

- ₹12,00,001 to ₹15,00,000: 20%

- Above ₹15,00,000: 30%

-

Tax Calculation Example: If your income is ₹10 lakh, the first ₹3 lakh is tax-free. The next ₹3 lakh incurs a 5% tax (₹15,000), the subsequent ₹3 lakh incurs a 10% tax (₹30,000), and the remaining ₹1 lakh is taxed at 15% (₹15,000), resulting in a total tax of ₹60,000.

-

Exceptions and Deductions: Unlike the old regime, the new system doesn’t allow for claiming certain exemptions. However, there’s a silver lining for salaried individuals who can deduct an additional ₹50,000 from their income as a standard deduction.

-

Income Threshold: Good news for those earning less than ₹7 lakh—no tax is applicable. Your income remains tax-free under the new regime.

In essence, the new tax regime comes with its nuances, emphasizing simplicity in tax slabs while foreclosing certain exemptions. Stay informed for more updates on navigating the evolving tax landscape.

If you want to study more about the official Tax Rates Visit here

Instructions to use Income Tax Calculator Excel Template:

Our Income Tax Calculator Excel Template is a comprehensive tool that assists you in calculating your net taxes. It covers various aspects of your income, deductions, exemptions, and tax slabs, providing a holistic view of your financial standing. Let’s delve into the key sections:

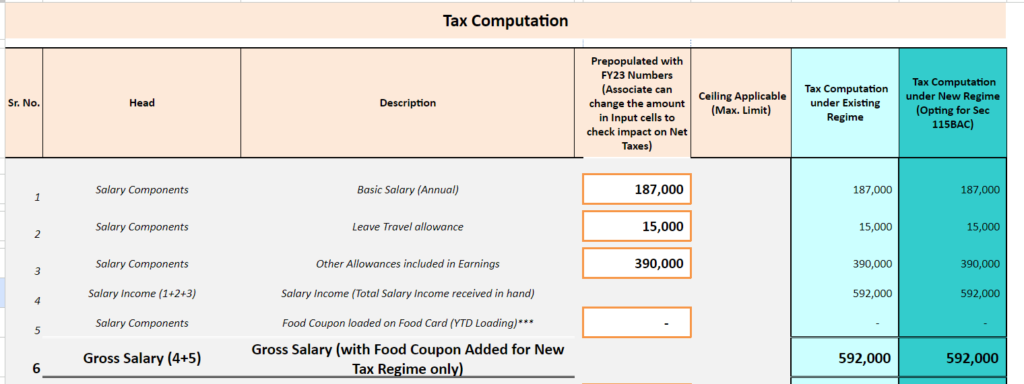

1. Salary Component:

- Enter your Basic Salary, Leave Travel Allowance, and Other Allowances, in the top most section of Income Tax Calculator.

- Prepopulated formula will automatically calculate your Gross salary first. As shown in below image:

2. Employer Contributions:

- In the second section of the Income Tax Calculator, Mention all contributions made by your Employer/Organization.

- Mention Accommodation provided by employer, Car/Automotives provided by employer, PF contributions etc.

- Again the prepopulated formula will calculate your gross salary accordingly.

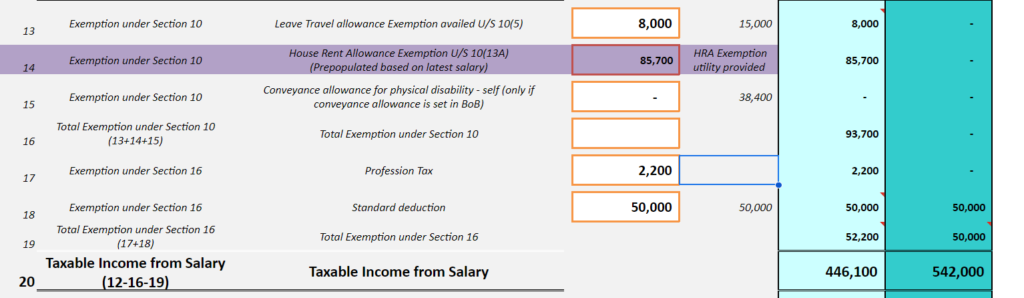

3. Exemptions Under Section 10:

- The 3rd section of Income Tax Calculator Excel is about exemptions under Section 10

- Enter Leave Travel Allowance that has been availed by you, (Supporting document like Flight tickets, boarding pass and travel bills would be required while filling up the ITR)

- Enter House Rental Allowance for Exemption. (Use HRA Exemption Assistant sheet provided in the Income Tax Calculator Excel to find our your exact HRA Exemption amount)

4. Exemptions Under Section 16:

- In the same section, there is fields to mention Exemptions Under Section 16, which includes Professional Tax, Standard Deduction(50,000)

- Check your payslip and mention the Professional Tax that has already been deducted as part of your state government Tax Scheme. This comes under the Exemption under Section 16.

- The Total Exemption including Section 10 and Section 16 will be calculated on the final cell of this section, as below image shows:

5. Additional Income:

- This section of the Income Tax Calculator Excel, lets you mention your additional income sources other than your salary.

- You can mention any income from House Property, also mention your House Loan Interest as Deduction, Earning from Banks like Fixed Deposit, Postal Deposit etc.

6. Chapter VI-A Deductions:

- This section of Income Tax Calculator, has comprehensive details to mention about all the underlying relief under Chapter VI A.

- Which contains sections like, 80CCC, 80CCD, CCE, 90D

- Deduction in respect of life insurance, annuity, Provident Fund(PF), Equity share. etc. needs to be mentioned

- All the details are mentioned in well described manner, in the Income Tax Calculator Excel itself.

- The limit is Rs. 1.5 Lakh together with section

- You Can read more about the Section 80C Here

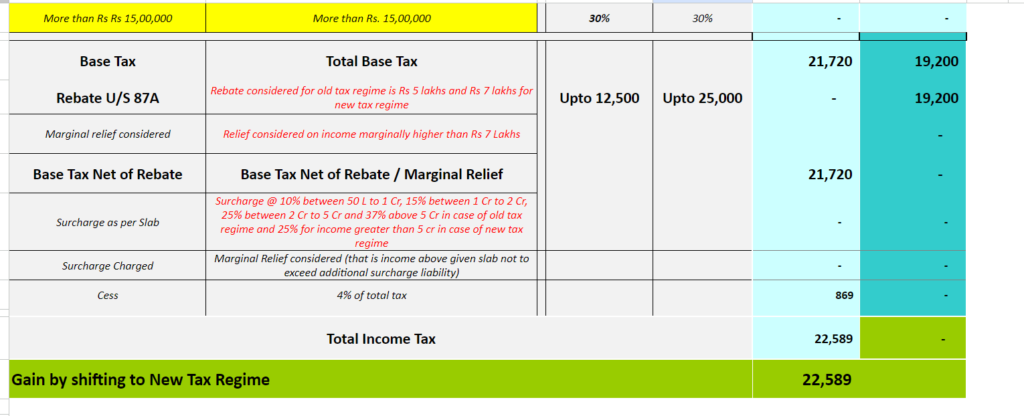

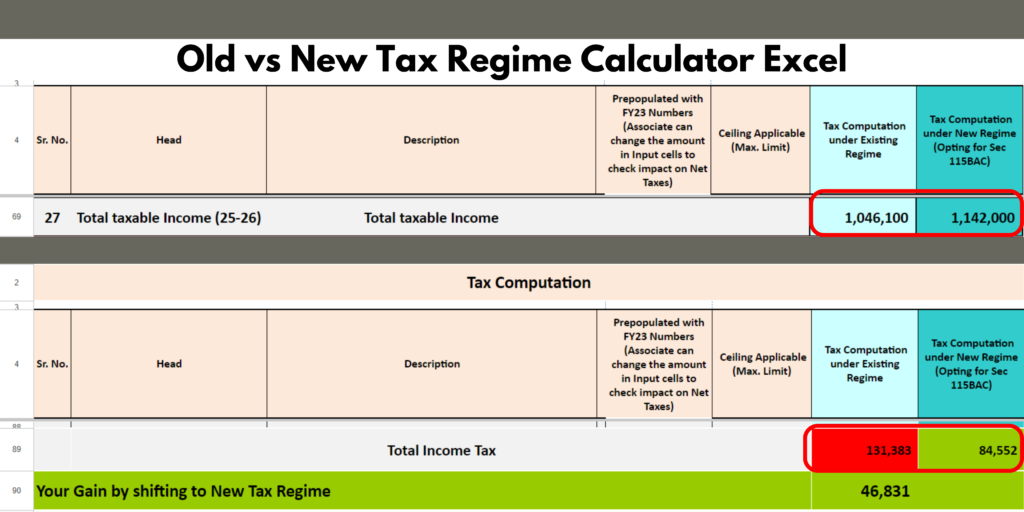

7. Taxable income and Tax:

- Once all the parameters are mentioned, your Taxable income and total Tax in both New Regime and Old Regime will be mentioned as below image:

Which tax regime should you choose?

Choosing the right Tax Regime is depends on your individual financial goals and plans.

To know the difference between the Old and New Tax Regime, you can read here.

However, if your primary focus is to identify the Tax Regime that offers the most tax savings tailored to your specific financial scenario, our Income Tax Calculator Excel is an invaluable tool.

Within the spreadsheet, our calculator seamlessly computes your earnings, deductions, and exemptions concurrently under both the Old and New Regimes. The culmination of this process provides a clear snapshot, detailing your total taxable income and tax liabilities for both Tax Regimes. This overview helps you to make an informed decision on which Tax Regime is most beneficial for the financial year 2023-24, aligning with your tax-saving objectives.

Examining the snapshot above reveals a distinct outcome: for this particular financial scenario, the Tax Liability under the Old Regime surpasses that of the New Tax Regime.

It’s crucial to recognize that results can vary based on your unique financial circumstances. To obtain a precise assessment and make a well-informed decision regarding the optimal Tax Regime for your financial settings, ensure thorough and accurate entries of all your earnings and deductions. This meticulous approach guarantees that the calculation aligns with your specific situation, guiding you towards selecting the Tax Regime that best suits your financial objectives.

How to Calculate HRA Exemption :

For the computation of HRA Exemption, a key component for salaried individuals falling under Section 10 (13A), our Income Tax Calculator Excel features a dedicated sheet called the “HRA Exemption Assistant.” This tool serves as your guide in assessing the eligible HRA deduction tailored to your unique circumstances. By scrutinizing each month individually, it enables an accurate calculation of HRA, allowing you to strategically save on taxes.

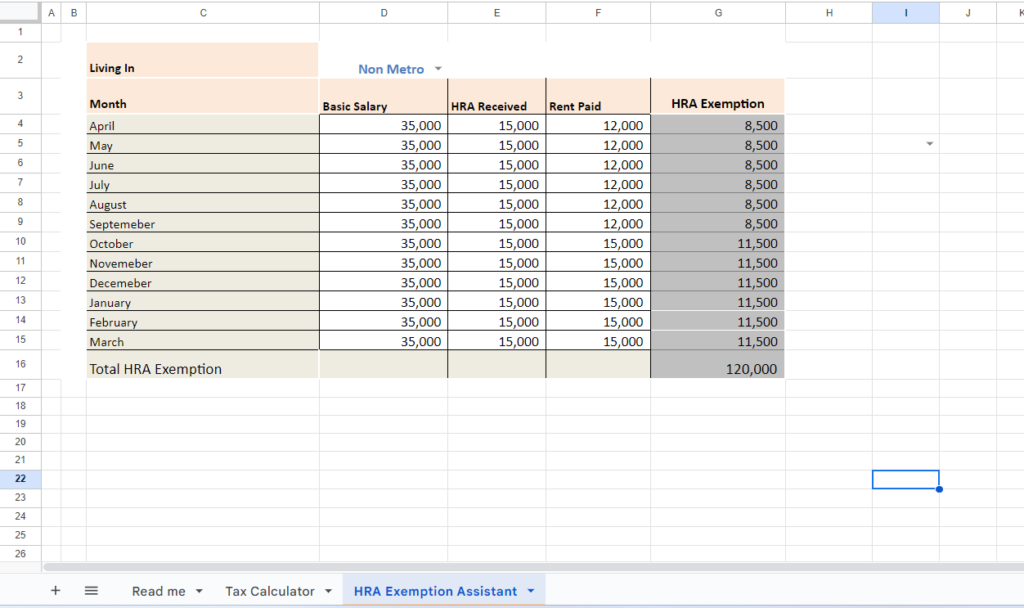

Below are the snapshots of HRA Exemption Assistant to better guide you.

In the provided snapshot, the user has input their essential details, including a Basic Salary of ₹35,000, an HRA component of ₹15,000, and rent payments up to September at ₹12,000, and from October to March at ₹15,000.

The HRA Exemption calculator adeptly computes both the monthly and cumulative deductions for HRA which is ₹1,20,000, presenting the final annual deduction that can be subtracted from the taxable income. It’s worth noting that selecting the appropriate city type at the top—either Metro or Non-Metro—is crucial, as this choice determines the percentage at which the HRA can be deducted, adding a nuanced precision to the calculation.

We have an Online Tool available as well to calculate your HRA Exemption on your mobile or web.

Click Here to calculate your HRA Exemption with online calculator.

Download Income Tax Calculator Excel Here

Click below button to download Income Tax Calculator Excel:

Please Note: This calculator provides a general estimate for salaried employees. For precise results, consider consulting a tax professional and accounting for individual circumstances. Use with caution, as it may not cover all factors affecting your tax liability.

Conclusion:

In conclusion, our Income Tax Calculator Excel, provides you a comprehensive tool to calculate your income tax to help you plan your financial goals and journey, as well as it serves as a decision-making ally, to decide your optimal Tax Regime, by descriptive calculation of taxable income and Tax Liabilities as per Old and New Tax Regime.

Click here to read more.

If you have any query or concern, feel free to drop us a mail at: info@corporatetofinance.com

Pingback: HRA Exemption Calculator - corporatetofinance.com

Pingback: Old vs New Tax Regime calculator excel - Download Income Tax Calculator Excel - corporatetofinance.com

Pingback: TCS Fresher Salary - Proven TCS Ninja, TCS Smart and TCS Digital Salaries 2024 - corporatetofinance.com

Pingback: Best Salary Hike Calculator - How to calculate salary hike 2024